tax on unrealized gains india

So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a 10 gain. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this.

Capital Gains Tax In India An Explainer India Briefing News

Capital Assets other than Equity Shares.

. Somehow in the next year the company sells the securities at 150000 by booking a realized gain of 50000 in the current years net profits. This owner employs hundreds of workers and the business is the economic cornerstone of a small community. If the proposal were to pass billionaires.

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. For example your pocket cash is USD it is still USD. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

10 of capital gains of more than Rs 1 lakh. An unrealized gains or losses are also called a paper profit or paper loss because it is recorded on accounting systempaper but has not actually been realized. So you realized a 10 gain.

In total 215 billion could be collected over nine years with. As per section 451 of the Income tax Act 1961 any profits or gains arising from the transfer of a Capital Asset effected in the previous year shall be chargeable to income tax under the head -Capital gains and shall be deemed to. Type of Capital Asset.

A tax on unrealized gains would harm the economy. Under Bidens plan you would be asked to pay Uncle Sam 20 on the gainseven if you had no intentions of selling your house. As we approach the last date 17th April 2012 for filing tax returns for the year 2011 heres some help for NRIs living in the US on how their income from India gets taxed.

Biden Backs Tax on Billionaires Unrealized Investment Gains Laura Davison 9242021 Chevron California refinery workers ratify contract. For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain. If you a US resident or US citizen whether NRI PIO or OCI you must pay taxes in the US on your.

Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. To know more about the taxability of mutual funds check here - Taxation of Mutual Funds for FY 2021-22 AY 2022-23.

You only adjusted from exchange rate eg. Answer 1 of 2. Income computation and disclosure standards ICDS The CBDT has notified ten ICDS to be followed by all taxpayers that follow the mercantile system of accounting for the purpose of computation of income chargeable to income tax under the head profits and gains of business or profession or income from other sources and not for the purpose of maintenance.

Lets say you bought a house at 500000 a decade ago and now its valued at 2 million. Yellen had first proposed the tax on unrealised capital gains in February 2021. Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone.

Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving much-needed capital. By example consider the owner of a large S corporation worth 200 million. This expenditure is a temporary difference for deferred tax purpose hence needs to be accounted for calculation of deferred tax.

Tax on global income in the US. The Unrealized Exchange Gainloss arisen on account of any capital asset covered under Section 43A of the Act is not allowed to be added in case of loss or taxed in case of gain since Section 43A treats the same on. The first example is realized because you sold the stock for 1100.

Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Houses Are Subject To Capital Gains Tax Just Like Stocks. If the value drops to 190000 you have a 10000.

13 May 2009 Unrealised gains since belong to a loan taken for purchase of capital assets the same will be charged to P L Account as per As 11 Before amendment and as per tax the same would not be allowed. Most Read from. Bloomberg -- President Joe Bidens proposal to tax the unrealized gains of some of the richest Americans has taken legislative form with a new bill from two House Democrats.

Its tax filing season in the US. 89-98F Refer Appendix 1 98G Recognition of Deferred Tax Assets for Unrealised Losses Amendments to Ind AS 12 amended paragraph 29 and added paragraphs 27A 29A and 98G and the example following paragraph 26An entity shall apply those amendments for annual periods beginning on or after -1An entity shall apply those amendments retrospectively in. The profit booked will be only paper profit and the company is not liable to pay any taxes for recording unrealized gains.

In the second example those are unrealized gains because while youre currently up 10 over your investment if the. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains. So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same.

The capitalization under the Income tax Act is solely governed by the provisions of Section 43A of the Income tax Act 1961. 1KHR 4000 to another exchange rate eg.

How Much Tax Will Be Applied On Short Term Capital Gains Quora

Do You Know What Is The Mutual Fund Taxation For Fy 2020 21 Advisorkhoj

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Do You Pay Taxes On Unrealized Gains For Trading Securities Universal Cpa Review

10 Financial Assets Pdf Securities Finance Equity Finance

Deductibility Of Foreign Exchange Fluctuations In Case Of Capital Assets

Eu Spot Market Module Prices Climate Targets Pv Price Trends For 2030 A Viable Mix Pv Magazine International

Should I Disclose Profits As Capital Gains Mint

How To Reduce Capital Gains Tax Liability For The Year

How To File Itr For Upstox Learn By Quickolearn By Quicko

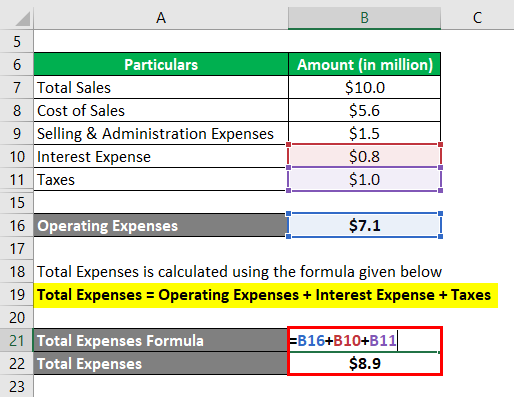

Profit Margin L Advantages And Limitations Of Profit Margin

How Biden S Tax Hike Could Affect Crypto Holders

Tax Loss Harvesting How To Use Bear Markets To Save Tax Primeinvestor

How Much Tax Will Be Applied On Short Term Capital Gains Quora